CH6 - Assessing customer profitability

Monday, June 10, 2013

4:14 PM

- Organization's expenses also include MSDA expenses

- Marketing, selling, distribution, and administration

- This chapter deals with how to extend activity-based costing to trace MSDA expenses directly to customer orders and individual customers

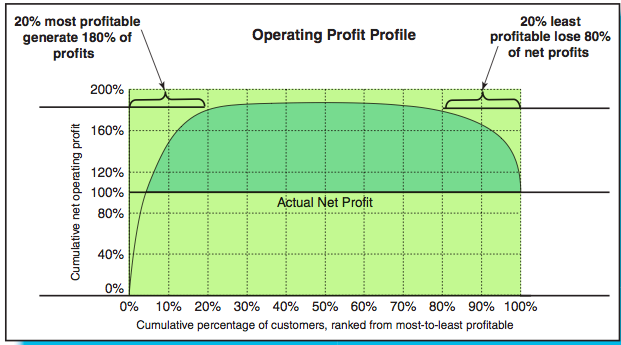

- The top 20% of the most profitable product generate 80% of the total value

- The lower 40% account for 1% of the total value

- Start with 2-column table with ID in column A and profit/loss in column B.

- Sort the customers by most profitable to least profitable.

- Calculate cumulative profit

- Create a chart

- Need both financial and non-financial measures

- Extend ABC to trace MSDA expenses directly to customers to evaluate costs of customer satisfaction, etc

- Quantify customer satisfaction, loyalty, willingness to recommend - serves as leading indicators of future revenue and performance

- Transform them

- Into profitable ones. How?

- Page 226

- "fire them"

- Force them to sale alternate suppliers

![]() Background

Background

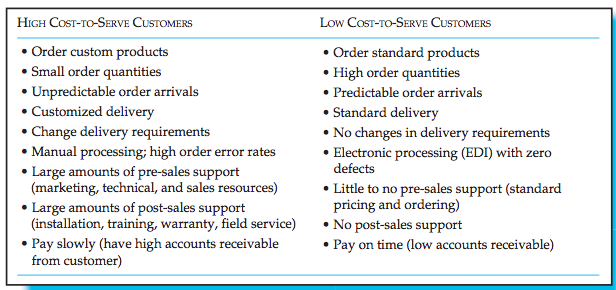

![]() Characteristics

of customers

Characteristics

of customers

Whale curve

The 80-20 Rule

![]() Construction

of a Whale curve

Construction

of a Whale curve

Class notes:

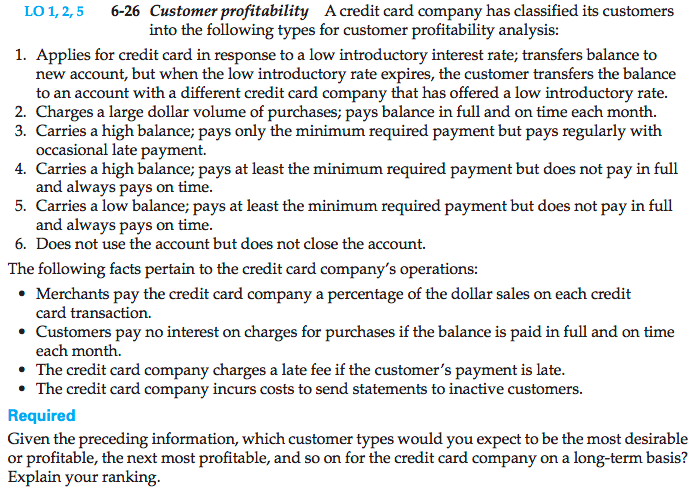

Opportunity to identify unprofitable customers

Problem 1

3

4

2

5

1

6